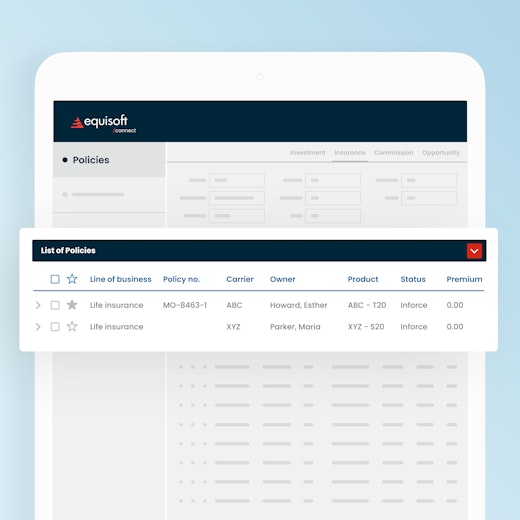

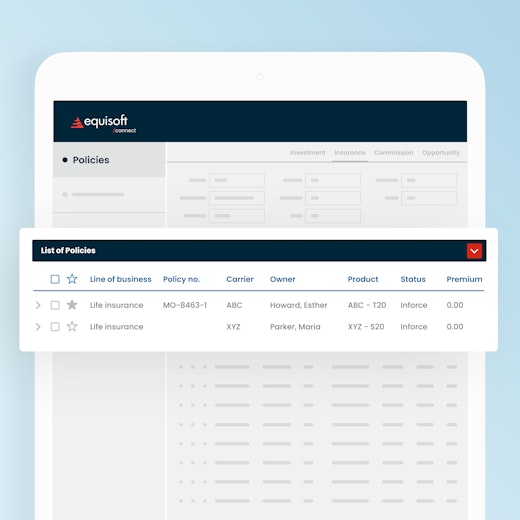

Auto-Integrate Your Book of Business Into the CRM

Seamlessly pull client data from our vast gateway network of back-offices. No manual data entry.

Seamlessly pull client data from our vast gateway network of back-offices. No manual data entry.

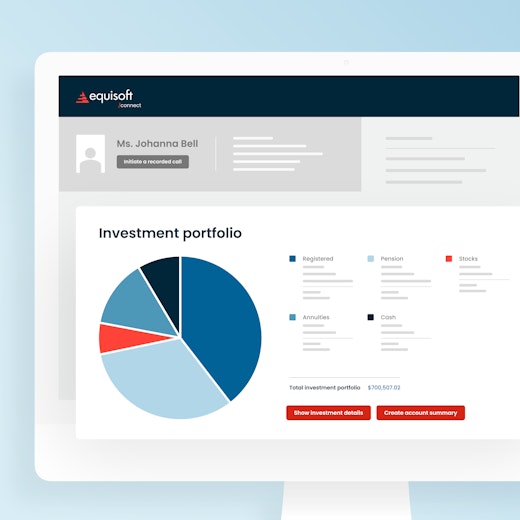

Up-to-date insurance & investment portfolios are just seconds away.

Do it directly from within the CRM platform and make logging into endless insurance or wealth management websites a thing of the past.

Seamlessly pull client data from our vast gateway network.

It’s like a virtual assistant that makes sure follow ups or reminders aren’t missed.

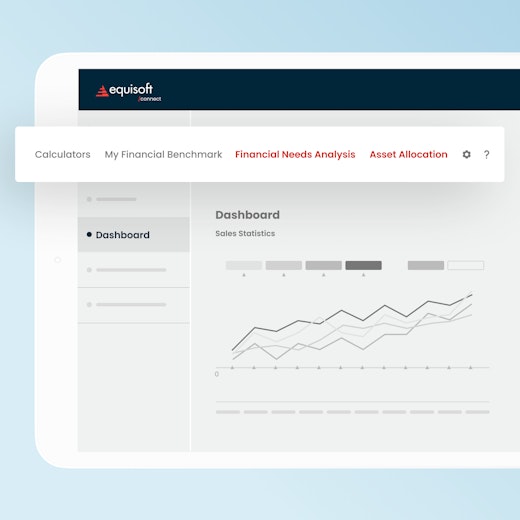

Bring the tools & workflows you depend on everyday into the CRM system seamlessly.

20,000+

Insurance professionals

15,000+

Financial advisors

Enhance performance with automatic renewal & upsell opportunity alerts. Continuously monitor results through easy to produce activity and executive reports. Download the Equisoft/connect mobile app, and connect to CRM productivity wherever and whenever you need access to it.

Our solution seamlessly integrates data. You don’t need to manually enter your book of business.

Customer data loads automatically in the CRM via our vast network of data gateways for a full financial picture of your client.

Combine Equisoft/connect with our Plan and Analyze applications to form a world class suite of advisor tools so powerful you won’t know how you did business without them.

Personalized training, helpdesk support, and automated data integration, all ready to go.

Colors, logos, disclaimers, single sign-on with other IPC advisor tools, it’s all doable.

From login to the application and its connections, everything is secure.

François Laporte

Financial Advisor and Broker Representative

Vice President, Global Alliances & Acquisitions

François has over 17 years of experience in technology development, corporate strategy and leadership. He’s an expert at developing financial services software solutions.

See more insights from François

Get started right now with your monthly subscription

Connect is ideal for large enterprise use